When we talk about managing our money, the conversation often gets stuck on one thing: saving more. But what if I told you that the real secret to financial well-being isn't just about squirreling away every penny? It's about shifting your focus to intentional spending—making sure every dollar you spend aligns with your values and moves you closer to your long-term goals.

It's about getting real with the psychology behind your purchases, crafting a spending plan you can actually stick to, and prioritizing building real wealth over just accumulating more stuff.

Move Beyond 'Saving More' to Truly Spending Wisely

Let's be honest, the old advice to "spend less than you earn" sounds simple enough, but putting it into practice is a different story. The real hurdle isn't the math; it's understanding the why behind our spending habits. True financial control isn't about feeling restricted. It's about feeling empowered. It’s about knowing exactly where your hard-earned cash is going and making sure it's doing a job you hired it for.

Let's be honest, the old advice to "spend less than you earn" sounds simple enough, but putting it into practice is a different story. The real hurdle isn't the math; it's understanding the why behind our spending habits. True financial control isn't about feeling restricted. It's about feeling empowered. It’s about knowing exactly where your hard-earned cash is going and making sure it's doing a job you hired it for.

So many of us get caught in a cycle where our spending habits keep us stuck, no matter how much we make. You get a raise, and before you know it, lifestyle inflation has swallowed it whole. It’s the small, seemingly harmless expenses that quietly chip away at your financial future.

Reframe Your Financial Mindset

To really start spending money wisely, you have to change how you think about it. Stop seeing a budget as a set of rules or a chore. Instead, think of it as an action plan for your life. It's the blueprint that directs your money toward what you genuinely value, whether that's traveling the world, retiring a decade early, or just the peace of mind that comes with being debt-free.

When you make this mental shift, you start building mindful spending habits that naturally lead to big wins.

- You'll feel less financial stress. Having a plan gives you a sense of security and control that's priceless.

- Your savings will grow faster. When every dollar has a purpose, you'll be surprised how much more you have left to save and invest.

- You'll start hitting major life goals. A budget turns those "someday" dreams into a concrete, step-by-step roadmap.

I've found that the most powerful change is moving from a consumer mindset to an owner mindset. Instead of just buying products, start thinking about how your money can buy you freedom and future opportunities. Every dollar spent is a vote for the kind of life you want to build.

Understand Your Spending Triggers

Let's face it: our spending is often driven by emotions and outside pressures, not logic. Social media is a huge one, creating a powerful sense of FOMO (fear of missing out) that can trigger impulse buys we later regret. Other times, it's stress or boredom that has us clicking "add to cart" for a quick dopamine hit.

The first step to taking back control is simply identifying what these triggers are for you.

A practical way to start is by consciously looking for value in every purchase. Before you buy something, take a beat and ask yourself if its true value to you matches its price tag. To get really good at this, learning how to compare prices shopping online is a non-negotiable skill that ensures you’re not overpaying.

At the end of the day, wise spending is just about making a series of conscious choices. They might seem small individually, but they compound over time to create massive financial well-being.

Creating Your Personal Spending and Savings Plan

Let's be honest: a rigid, one-size-fits-all budget is a recipe for failure. To truly get a handle on your money, you need a flexible plan that actually fits your life.

The first step? Getting a brutally honest look at where your money is going right now. You don't need fancy software for this. A simple spreadsheet works wonders, or you can use an app like Rocket Money to automatically pull in your transactions and show you exactly where every dollar is headed.

This tracking phase can be a real eye-opener. You might find those "small" daily coffees are adding up to a car payment, or that you're spending way more in a category you barely even thought about. This isn't about shaming yourself; it's about gathering cold, hard facts so you can make smarter decisions. Without this clarity, you're just guessing.

It’s surprising how many people skip this step. In fact, a shocking 36% of American households don't have a documented, long-term financial plan. Many people fall into the trap of thinking they don't have "enough" money to need a plan, but that's exactly when a plan is most critical. It’s what helps you break the cycle and start putting your money to work.

Building Your Framework for Wise Spending

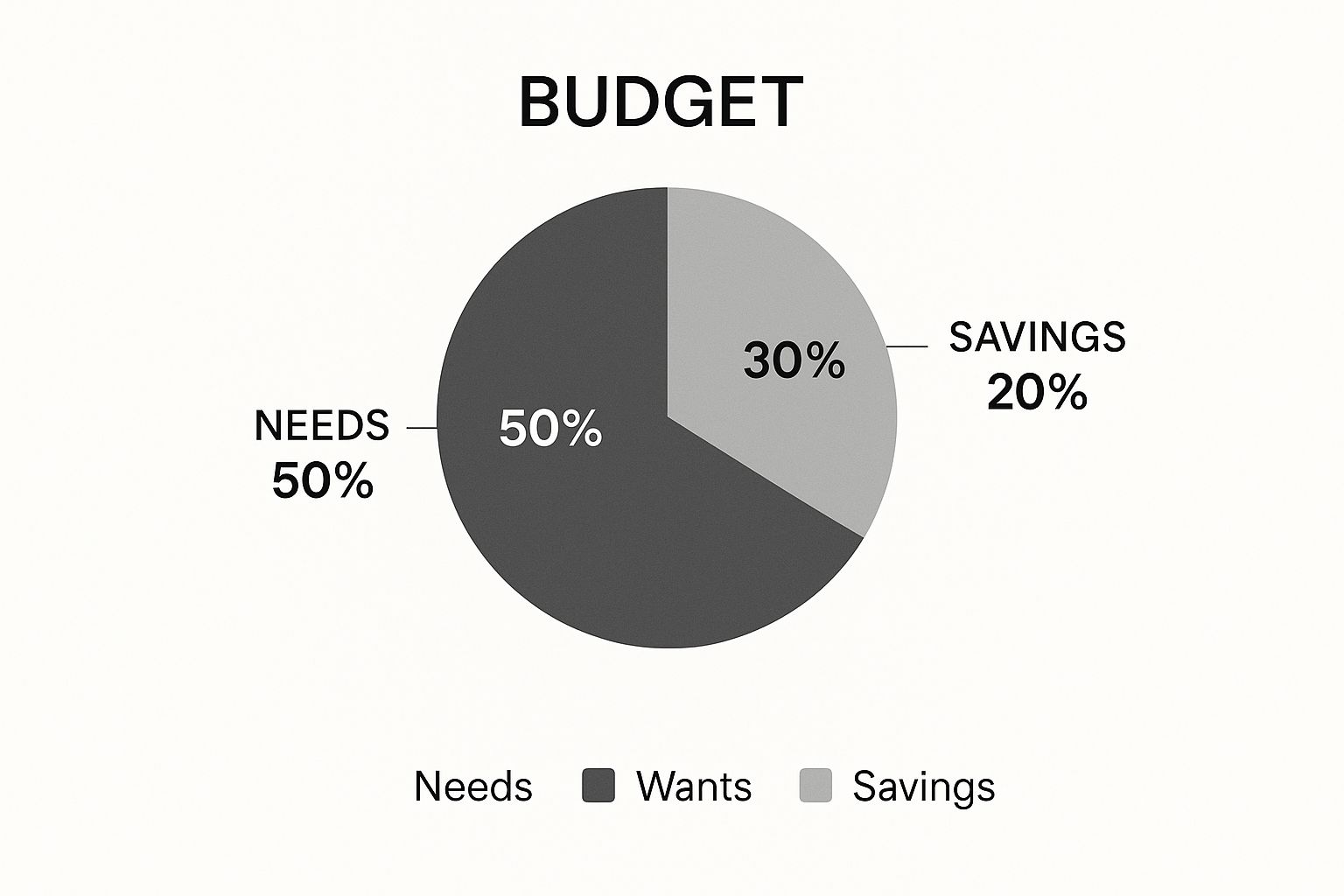

Once you know where your money is going, you can start telling it where to go. I've found that the 50/30/20 rule is a fantastic starting point—but treat it as a guideline, not gospel. It gives your spending a simple, powerful structure.

Here's the breakdown:

- 50% for Needs: This is the non-negotiable stuff. Think housing, utilities, groceries, and getting to work.

- 30% for Wants: This is the fun money—the things that make life enjoyable but aren't strictly essential. We're talking dining out, hobbies, and entertainment.

- 20% for Savings & Debt Repayment: This is your "future you" fund. It covers building an emergency fund, investing for retirement, and knocking out high-interest debt.

Key Takeaway: Don't obsess over hitting these numbers perfectly each month. The magic of this framework is that it forces you to consciously divide your income into these three buckets. You start actively building your future instead of just reacting to bills as they come in.

Putting Your Spending Plan into Action

Let me give you a real-world example. I once worked with a client, Alex, who was constantly stressed about money despite earning a good salary. After we tracked expenses for just one month, the problem became obvious: a huge chunk of cash was disappearing into impulse buys and a dozen subscription services they'd forgotten about.

Using the 50/30/20 framework, Alex took back control. We slashed the "Wants" budget by canceling unused subscriptions and setting a realistic weekly limit for eating out. That freed-up money was immediately rerouted to the "Savings" bucket to build up a dangerously low emergency fund. For a deeper dive into these techniques, mastering budgeting is an excellent resource.

This isn't about deprivation. Alex still enjoyed life, but the spending became intentional. The plan gave them permission to spend on wants within a set limit, which completely eliminated the guilt and created a sustainable system. That's the core of spending money wisely: making sure your dollars align with your values and goals.

Developing Mindful and Intentional Spending Habits

Shifting from a reactive spender to a proactive one isn't just about spreadsheets and budgets; it's a fundamental change in mindset. Learning how to spend money wisely means you have to get honest about the 'why' behind every purchase. It’s about becoming a conscious consumer who is firmly in control, instead of letting impulse or social media trends make your financial decisions for you.

The first, most critical step is creating a deliberate pause between the urge to buy and the action of buying. Retailers are masters of creating urgency, making you feel like you need that item right now. A simple, yet incredibly powerful, technique to counteract this is to enforce your own cooling-off period for anything that isn't an absolute necessity.

Master the 30-Day Rule

When a significant, non-essential item catches your eye—whether it's a new gaming console, a designer jacket, or the latest smartphone—don't pull out your wallet. Instead, put the 30-day rule into practice. Just write down what you want and wait 30 days before making a decision.

You'd be surprised how often that initial, intense excitement just fizzles out. After a few weeks, you often realize it was a fleeting want, not a genuine need. This simple delay can save you from a lifetime of impulse buys. If you're looking for more strategies like this, our guide on how to shop smarter is a great next read.

Calculate True Value with Cost-Per-Use

Here's another game-changing tactic: stop focusing on the upfront price and start thinking about long-term value. This is where calculating the cost-per-use of an item becomes a secret weapon for smart spending.

Let's look at a common scenario. You're trying to decide between a cheap, $30 pair of trendy shoes and a durable, well-made $150 pair.

- The Cheap Pair: You might get 15 wears out of them before they look worn out or break. That works out to a cost-per-use of $2.00.

- The Quality Pair: These are built to last and could easily see 300 wears. Their cost-per-use is just $0.50.

All of a sudden, the "expensive" shoes are clearly the better financial choice. Adopting this perspective encourages you to invest in quality that endures, which saves you money and cuts down on waste in the long run.

The most impactful financial habit is learning to distinguish between price and value. A low price tag can be tempting, but true value lies in an item's durability, utility, and its alignment with your long-term goals.

Identify Your Personal Spending Triggers

Finally, it’s time to get brutally honest about what drives your unplanned spending. For most of us, our financial choices are deeply connected to our emotional state.

What sets off your urge to spend? Common triggers often include:

- Stress: "Retail therapy" as a quick but costly fix.

- Boredom: Mindlessly scrolling through shopping apps to kill time.

- Social Pressure: The classic "keeping up with the Joneses" (or the Kardashians).

- Celebration: Marking a win with an extravagant purchase.

Once you know your triggers, you can plan healthier responses. If stress makes you want to shop, try going for a run or calling a friend instead. If boredom is the culprit, delete those tempting shopping apps from your phone. By taking control of these emotional triggers, you put yourself back in the driver's seat, ensuring every dollar you spend is a deliberate choice that actually serves you.

Make Your Emergency Fund a Top Priority

True financial resilience isn't just about hunting for bargains or trimming your budget. It’s about building a buffer that shields you from life's inevitable curveballs. This is exactly where your emergency fund comes in.

Think of it less like optional savings and more like the most important bill you pay each month—a payment to your future, more secure self.

An emergency fund is your personal financial safety net. It gives you the power to handle the unexpected—a sudden job loss, a surprise medical bill, or an urgent home repair—without completely upending your life. Without that cushion, a simple car breakdown can quickly snowball into high-interest credit card debt, trapping you in a cycle that's incredibly tough to break.

Calculating Your Financial Safety Net

So, how much do you actually need? The rule of thumb I always share with people is to aim for 3 to 6 months of essential living expenses.

To figure out your personal target, you first need to get brutally honest about your non-negotiable monthly costs. I’m not talking about wants; I’m talking about pure survival expenses.

Your list should include:

- Housing: Your rent or mortgage payment.

- Utilities: What you pay for electricity, water, heat, and internet.

- Food: Your realistic, bare-bones grocery budget.

- Transportation: Gas, public transit passes, or car insurance.

- Core Bills: Minimum debt payments and essential insurance premiums.

Once you add all those up, you have your monthly survival number. Let's say your essential expenses come out to $2,500 a month. A good starting goal would be a $7,500 emergency fund (that’s your 3-month buffer). Your ultimate goal should be $15,000 (a full 6 months).

This might feel like a huge number, but don't get discouraged. You get there one step, one paycheck at a time.

To see how this works, take a look at these examples.

Emergency Fund Savings Goals

| Monthly Expenses | 3-Month Fund Target | 6-Month Fund Target |

|---|---|---|

| $2,000 | $6,000 | $12,000 |

| $3,500 | $10,500 | $21,000 |

| $5,000 | $15,000 | $30,000 |

This table shows just how scalable the goal is. Your target is entirely based on your unique living costs, not some arbitrary number.

Automate Your Savings to Make It Effortless

From my experience, the single most effective way to build a fund is to make it automatic. Don't leave it to chance or willpower. Treat your savings contribution like any other recurring bill and set up an automated transfer from your checking to a separate savings account every payday.

This "pay yourself first" approach takes the decision-making out of it, ensuring you’re consistently chipping away at your goal.

This strategy is more critical now than ever. Recent data reveals that only 48% of Americans have enough savings to cover a three-month emergency. With so much uncertainty in the air, building your own buffer is one of the most powerful financial moves you can make.

Here's a real-world example: Imagine two people, Sarah and Tom, who both get laid off. Sarah has a six-month emergency fund. She can take her time, breathe, and search for a new role that's a good fit without panicking about money. Tom has no savings. He's forced to grab the first low-paying job he's offered, all while racking up credit card debt to cover his bills. That one setback could derail his financial progress for years.

Where Should This Money Live?

The key here is finding a perfect balance between safety and accessibility. You want the money to be out of sight so you aren't tempted to dip into it for a non-emergency, but you also need to get to it fast when a true crisis hits.

As this breakdown shows, savings should be a core component of your budget—around 20% is a great target. This is the exact slice of your income you can use to build your fund.

Beyond just saving, deciding on where to keep your emergency fund is a crucial step. For most people, a high-yield savings account is the sweet spot. It keeps your money liquid and accessible while earning a much better interest rate than a traditional savings account at a brick-and-mortar bank.

Improve Your Financial Literacy to Spend Smarter

Wise spending often feels like a test of willpower, but I've found it's really a test of knowledge. When you don't know the rules of the financial game, it’s all too easy to make expensive mistakes without even realizing it. That gap between what we know and what we *need* to know is where financial trouble almost always starts.Simple concepts can make a massive difference. For instance, not fully grasping how credit card interest compounds can quickly turn a small treat into a long-term debt headache. The same goes for glossing over the fine print in a loan agreement or not understanding how your credit score directly affects the interest rates you're offered. These small oversights can cost you thousands over time.

Bridge Your Knowledge Gaps

Becoming financially literate isn't about turning into a Wall Street wizard. It's about getting a handle on the practical, everyday skills that protect your money. And honestly, it's a huge challenge for most people.

A recent Personal Finance Index from the TIAA Institute and the Global Financial Literacy Excellence Center revealed a sobering statistic: U.S. adults could only answer 49% of financial questions correctly. The biggest weak spot? Understanding risk, where only 36% of questions were answered right. That's a critical skill for making smart spending decisions, and this gap makes it tough to balance today's wants with tomorrow's needs.

A fantastic first step toward getting a clear picture of your financial health is to check your credit reports regularly. Knowing what lenders see helps you understand your borrowing power and spot any errors that might be costing you. There are simple guides available that walk you through how to get all three credit reports free, an easy action that delivers a ton of clarity.

The goal isn't just to memorize financial terms. It’s about building genuine financial confidence. When you truly understand the 'why' behind money management, you're much more likely to stick to your goals and sidestep those common traps.

Accessible Resources to Boost Your Financial IQ

The good news is you don't need a degree in economics to get smarter with your money. It all comes down to finding trustworthy resources that you actually enjoy using.

Here are a few easy ways to get started:

- Tune into a podcast on your commute. Shows like The Ramsey Show or Afford Anything do a great job of breaking down complicated money topics into simple, real-world advice.

- Read one chapter of a finance book each week. Classics like The Simple Path to Wealth by JL Collins or I Will Teach You to Be Rich by Ramit Sethi provide incredibly practical game plans.

- Follow a few reputable financial blogs or websites. They offer up-to-the-minute articles on everything from budgeting hacks to investment basics.

By taking the mystery out of personal finance, you give yourself the tools to confidently compare everything from credit cards to mortgages. This knowledge is your single best defense against emotional spending and costly mistakes. For some targeted strategies on reining in those split-second purchase decisions, take a look at our guide on how to avoid impulse buying.

The more you learn, the more intentional and powerful your spending becomes.

Your Top Smart Spending Questions, Answered

Even with a solid plan, real life throws curveballs. I get it. Over the years, I've seen a few questions pop up again and again. Let's tackle some of the most common challenges you'll likely run into on your journey to smarter spending.

How Can I Spend Wisely on an Irregular Income?

When your income fluctuates, a rigid monthly budget just won't cut it. The name of the game is flexibility and building a solid cash-flow plan.

Your first step is to figure out your "bare-bones" budget. This isn't about everything you want to spend; it's only the absolute essentials—think rent, basic groceries, and keeping the lights on. During a good month, your top priority is to set aside enough cash to cover this baseline. Any extra income after that? It goes straight into building up your emergency fund. That fund is your secret weapon for smoothing out the lean months, letting you cover your essentials without the usual stress.

A "priority" spending system works wonders here. Just list all your expenses from most critical to least. As money flows in, you pay for them in that exact order. This simple trick guarantees your most important bills get handled first. It also helps to avoid long-term financial commitments wherever you can—sticking with pay-as-you-go services gives you the breathing room you need.

What Is the Best Way to Handle Unexpected Expenses?

This is exactly why you have an emergency fund. It's your first and best line of defense against those financial surprises life loves to throw at you.

But what if the unexpected bill is bigger than your emergency savings? Before you instinctively grab a high-interest credit card, take a breath. Your first call should be to the provider—whether it's the mechanic or the hospital—to ask about an interest-free payment plan. You'd be surprised how often they're willing to work with you. Next, scrutinize your budget. Can you pause all non-essential spending for a month or two to free up some extra cash?

Before you even think about taking on new debt, exhaust every other option. Could you sell some old gadgets or clothes you no longer use? A low-interest personal loan is a far better choice than credit card debt, but your own savings should always be the very first tool you reach for.

How Do I Balance Paying Off Debt and Saving Money?

This is the classic financial tug-of-war, but you don't have to choose one over the other. In fact, a balanced approach is almost always the most powerful strategy in the long run.

Most financial experts I trust suggest starting with a small, starter emergency fund of about $1,000. Think of this as your financial buffer. It’s what keeps a minor car repair from spiraling into new, high-interest debt while you’re working so hard to pay off the old stuff.

Once that buffer is in place, it's time to attack the debt. The "debt avalanche" method is incredibly effective. Here’s how it works:

- List all your debts, ordered from the highest interest rate down to the lowest.

- Keep making the minimum payments on all of them so you stay in good standing.

- Throw every extra dollar you can find at the debt with the highest interest rate.

- When that top debt is finally gone, take the entire payment you were making on it and roll it over to the next debt on your list.

This strategy creates a powerful momentum that really speeds up your progress. At the same time, keep making small, consistent contributions to your main emergency fund and retirement accounts. It's not just about the numbers; it's about building the lifelong habit of saving while letting compound interest start working its magic.

At FindTopTrends, we're all about helping you make smart, informed purchases that fit your financial goals. Whether you're looking for high-quality essentials or the newest trending products, we give you the information you need to shop with confidence. Discover curated deals and valuable insights to get the most out of every dollar you spend.