You’ve been there. You walk into a store just for milk and walk out with a full cart—and a much lighter wallet. That’s impulse shopping. It’s that sudden, undeniable urge to buy something you didn’t plan for, driven more by emotion than any real need.

Defining the Unplanned Purchase

Impulse shopping isn't just about grabbing a candy bar at the checkout counter. It’s a powerful behavior where a compelling desire to buy something hits you right now.

Unlike a planned purchase that comes after research and careful thought, an impulse buy is purely reactive. You see something, feel an instant connection, and suddenly you have to have it. This spontaneous decision-making has become a huge part of how we shop today. A staggering 84% of all shoppers admit to making impulse purchases, and on average, we make about three unplanned buys for every 10 store visits. You can read more about consumer impulse buying habits to see just how common it is.

Impulse Versus Intentional Shopping

The real difference is all in your head. A planned purchase solves a problem you already knew you had. An impulse purchase creates a brand-new want right on the spot. It’s the difference between buying a new winter coat because your old one is falling apart versus grabbing a flashy jacket just because it caught your eye.

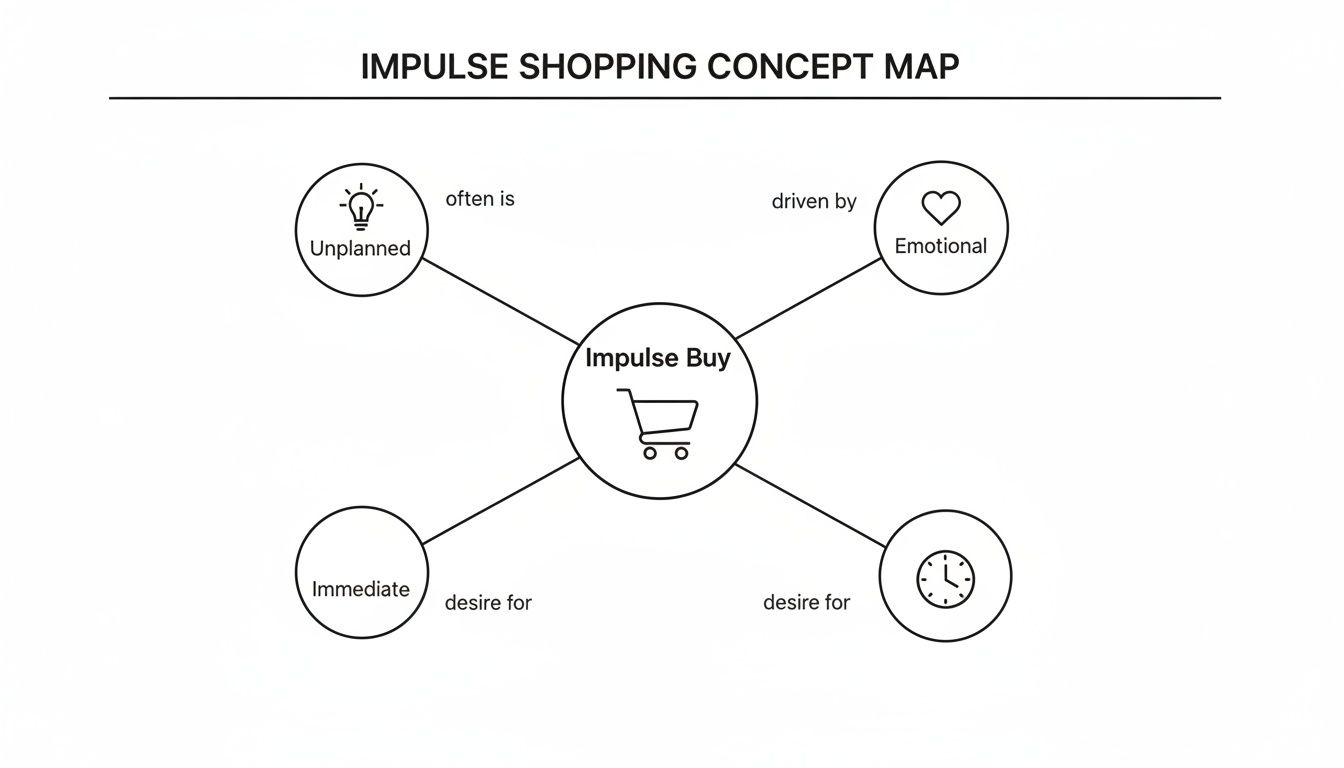

This little map breaks down the three core ingredients of any impulse buy.

As you can see, these purchases are totally unplanned, sparked by an emotional reaction, and happen in an instant without much—if any—real thought.

An impulse buy is less about the item itself and more about the feeling it provides at that exact moment—excitement, comfort, or a sense of reward.

To make this crystal clear, let's put these two shopping styles head-to-head.

Impulse Buy vs Planned Purchase At a Glance

The table below breaks down the key differences between a spontaneous splurge and a well-thought-out buy. It’s a simple look at the mindset behind each decision.

| Characteristic | Impulse Purchase | Planned Purchase |

|---|---|---|

| Decision Time | Instantaneous; made on the spot | Deliberate; involves thought and research |

| Emotional State | High emotion; driven by excitement or want | Logical; driven by need or practicality |

| Financial Plan | Not budgeted; spontaneous spending | Budgeted; funds are allocated ahead of time |

| Primary Driver | External triggers (e.g., sales, displays) | Internal need (e.g., replacing a broken item) |

Seeing them side-by-side, it's clear one comes from the heart and the other from the head. The impulse buy is an emotional reaction, while the planned purchase is a logical solution.

The Psychology Behind Spontaneous Spending

To really get what impulse shopping is, we need to look past the shopping cart and into our own minds. These spontaneous purchases are rarely about logic. Instead, they’re almost always driven by powerful psychological triggers that retailers have become experts at pulling.

At its core, an impulse buy is a showdown between your immediate emotional wants and your long-term, rational thinking.

The moment you see an item you suddenly have to have, your brain releases a hit of dopamine—the "feel-good" chemical linked to pleasure and reward. This creates a quick high, an exciting buzz that makes the urge to buy feel urgent and intensely satisfying. Retailers know this, and they design entire shopping experiences to spark that exact feeling, turning a simple errand into an emotional roller coaster.

Emotional Triggers That Open Our Wallets

Our feelings are the fuel for impulse buys. Whether we're happy, sad, or just plain bored, our emotional state can make us incredibly vulnerable to unplanned splurges. It's because we often use shopping to change or amplify how we feel in the moment.

The most common emotional drivers are surprisingly familiar:

- Retail Therapy: It’s a real thing. Many of us shop to soothe stress, anxiety, or sadness. The simple act of buying something new gives us a temporary distraction and a feeling of control, even if buyer's remorse is waiting just around the corner.

- Celebration and Reward: Had a great day at work? Aced a test? We often feel like we "deserve" a treat to celebrate. This self-reward mindset makes it easy to justify spending money on things we don’t actually need.

- The Boredom Buy: Mindlessly scrolling through online stores or wandering through a mall can easily lead to an impulse purchase. Sometimes, the hunt for something new and shiny is all it takes to trigger a purchase when you're just looking for a little stimulation.

An impulse purchase often serves an emotional need first and a practical one second—if at all. It's about buying a feeling, not just a product.

How Retailers Tap Into Our Brains

Retailers are masters of what's known as consumer psychology. They strategically design every inch of their stores and websites to nudge you toward making these split-second decisions. If you're curious, you can get a full breakdown of these tactics by learning more about what is consumer psychology and how it shapes our habits.

They pull this off using a few classic, time-tested methods designed to create a sense of urgency and desire.

Common Retail Tactics

- Fear of Missing Out (FOMO): This is probably the most potent weapon in their arsenal. Limited-time offers, flash sales, and "only 2 left in stock!" warnings create a powerful sense of urgency. The thought of missing a great deal can easily overpower our better judgment.

- Strategic Product Placement: Ever wonder why candy, magazines, and cold drinks are always stacked by the checkout counter? That’s no accident. Placing tempting, low-cost items in high-traffic areas is a proven way to encourage those last-minute additions to your cart.

- The Power of "Free": Deals like "Buy One, Get One Free" or "Free Shipping on orders over $50" are incredibly effective. The lure of getting something for free makes us feel like we're outsmarting the system, even if it means we end up buying things we never intended to.

How Online Shopping Fuels Impulse Buys

If you’ve ever walked into a store and been subtly guided by its layout, you’ve experienced retail psychology firsthand. But the online world has taken this to a whole new level, mastering the art of turning a casual browse into an instant "add to cart."

The entire digital shopping experience is engineered to be as smooth and persuasive as possible. It creates a personalized and incredibly convenient bubble that physical stores just can't replicate, making it almost too easy to act on a whim.

The Frictionless Path to Purchase

A core strategy for online retailers is to remove every possible obstacle between you and the checkout button. Think about the magic of one-click ordering. It’s genius, really. It bypasses that crucial moment of pause where you might reconsider while fumbling for your credit card.

Mobile shopping, in particular, has put a 24/7 superstore right in our pockets. This constant access makes it easier than ever to buy on impulse, anytime, anywhere. Many people rely on tools to manage this, and you can see some of the best online shopping apps that shoppers use to organize their finds.

The goal of many online retailers is to shorten the distance between "I want that" and "It's on its way." The fewer steps you have to take, the less time your rational brain has to object.

This seamless environment has completely rewired our shopping habits. A staggering percentage of U.S. shoppers now admit they're most likely to make impulse buys online. And the numbers don't lie: an incredible 40% of all money spent on e-commerce is from impulse purchases. The market itself has skyrocketed past 20 billion USD. You can discover more insights about online impulse shopping trends from Statista.

Personalized Triggers and Constant Reminders

Beyond sheer convenience, online platforms use your own data to dangle perfectly tailored temptations in front of you. These digital nudges are designed to keep products on your mind and create an urgent, compelling reason to buy right now.

Here are a few of the most common tactics you’ll see online:

- Personalized Recommendations: Sophisticated algorithms track everything—your search history, past purchases, even things you just glanced at. They use this to show you products you're almost guaranteed to like, effectively creating a want you didn't know you had.

- Targeted Social Media Ads: Ever feel like a product is following you around the internet? That’s retargeting. You look at a pair of shoes on one site, and suddenly, ads for those exact shoes pop up in your social media feed, keeping the temptation front and center.

- Email and Push Notifications: Messages like "Flash sale ends tonight!" or "An item in your cart is almost sold out!" land directly in your inbox or on your phone's home screen. They create a powerful sense of urgency that’s hard to ignore.

Understanding the True Cost of Unplanned Purchases

It’s easy to see the immediate cost of an unplanned purchase—it’s right there on the receipt. But the real damage from impulse shopping runs much deeper than a single transaction. It’s the slow, almost invisible pile-up of these "small" buys that can quietly derail your entire financial plan.

Think of each spontaneous purchase as a tiny leak in a boat. One drop seems like nothing, but give it time, and you’ll find yourself struggling to stay afloat. These seemingly harmless expenses can disrupt your budget, eat away at your savings, and push your long-term goals further and further out of reach.

The Snowball Effect in Action

Let’s get real about how fast these "little" purchases add up. It's a classic case of financial creep, where your money seems to vanish into thin air.

Consider a pretty common scenario:

- A daily $5 coffee: That morning latte feels like a well-deserved treat, but it adds up to $25 a week.

- Two weekly online splurges: A couple of $20 items you stumbled upon while scrolling? That’s another $40 a week.

Put them together, and you're suddenly spending an extra $65 a week. That might not set off alarm bells, but it translates to about $260 a month. Over a year, that’s more than $3,100. That's a vacation, a solid emergency fund, or a big chunk of debt paid off.

Buyer's remorse isn't just a fleeting feeling of regret; it's the emotional price tag of an impulse buy. It’s the stress that follows when you realize a temporary want has created a long-term financial complication.

On top of the immediate cost, impulse buys can feed into a cycle of financial anxiety. There are many strategies for financial anxiety relief out there, but breaking the spend-regret-stress cycle is a huge first step. It really can take a serious toll on your mental well-being.

More Than Just Money

The fallout from impulse shopping isn't just about the numbers on your bank statement. There are other hidden costs that we often ignore, but they have a very real impact on our lives.

Emotional and Physical Costs

- Increased Clutter: Every unplanned purchase needs a home. Over time, all this stuff leads to physical clutter, creating a disorganized and stressful living space that you then have to spend more energy managing.

- Decision Fatigue: Constantly fighting the urge to buy something is mentally draining. This internal battle chips away at your willpower, making it harder to make good decisions in other important areas of your life.

- Lost Opportunity: Every dollar you spend on a whim is a dollar you can't invest in your future. It's not just the money you've lost, but all the potential growth and security that money could have given you.

Seeing these hidden costs is the first step toward changing your habits. It’s about shifting from reactive spending to intentional saving, which puts you back in control of both your finances and your peace of mind.

Actionable Strategies for Smarter Shopping

Knowing what drives your impulse buys is one thing, but actually stopping them in their tracks requires a game plan. The trick is to put a little space—a deliberate pause—between that sudden urge to buy and the moment you actually click "confirm purchase." These simple strategies are like a mental speed bump, giving the logical part of your brain time to catch up with your emotions.

Building better habits isn't about harsh restrictions; it’s about making smarter, more conscious choices that serve your bigger financial goals. Weaving in a few practical frugal living tips can help you create a more disciplined financial routine and cut down on those spontaneous buys.

Create a Mandatory Waiting Period

Time is your single greatest weapon against impulse buying. Retailers love to create a sense of urgency because it forces you to make a quick, emotional decision. Your best defense is to simply slow things down.

Try implementing the 24-hour rule. Whenever you feel the pull to make an unplanned, non-essential purchase, just wait a day. This simple cooling-off period is usually enough for that initial dopamine hit to wear off, letting you look at the item with fresh eyes. You’d be surprised how often that "must-have" item feels completely unnecessary 24 hours later.

Build Your Shopping Blueprint

Browsing online without a clear goal is like walking into a supermarket when you’re starving—a recipe for bad decisions. A detailed shopping list is your roadmap, keeping you focused on what you actually came for.

Before you even open a new tab, jot down exactly what you need. This small step shifts you from being a passive browser, open to suggestion, to an active shopper on a mission. When you stick to the list, you’re less likely to be sidetracked by flashy banners or tempting "deals" that weren't on your radar. To take this a step further, learning how to compare prices online and save more with expert tips is the perfect next step after mastering your list.

A shopping list isn't just a reminder of what to buy; it’s a commitment to what you’ve decided not to buy. It’s your pre-made decision, protecting you from in-the-moment temptations.

Tidy Up Your Digital Environment

Your inbox and social media feeds are battlegrounds for your attention and your wallet. They're flooded with flash sale alerts, new product drops, and limited-time offers, all designed to trigger that fear of missing out. It's time to do some digital housekeeping.

Get on the offense and curate what you see every day:

- Unsubscribe from marketing emails: Spend 15 minutes unsubscribing from retail newsletters. If you never see the "50% off" email, you can't be tempted by it.

- Turn off app notifications: Go into your phone’s settings and disable push notifications for shopping apps. This stops those unexpected sale alerts from derailing your day and your budget.

- Curate your social feed: Unfollow brands or influencers who constantly make you want to shop. Your digital space should be a place that supports your goals, not sabotages them.

Putting these strategies into practice helps you move from being a reactive spender to a mindful one. Each step reinforces good habits, empowering you to make choices that benefit your long-term financial health, not just a fleeting whim.

Frequently Asked Questions About Impulse Shopping

Even after breaking down the psychology behind impulse shopping, you might still have a few questions. That's completely normal. Let's tackle some of the most common ones to clear up any lingering confusion and help you feel more confident about your spending habits.

Is All Impulse Shopping Considered Bad?

Not at all. Grabbing a new coffee flavor you spot at the store or buying a fun pair of socks that made you smile isn't going to sink your financial ship. A small, unplanned purchase that fits your budget and brings you a little joy can be a harmless treat.

The real danger zone is when impulse shopping becomes a habit you can't control. It crosses the line from a simple pleasure to a real problem when it causes financial stress, racks up debt, or leaves you with a consistent feeling of regret.

Many people strike a healthy balance by building "fun money" right into their monthly budget. This gives them a guilt-free fund for those spontaneous buys without derailing their financial goals.

How Can I Spot Problematic Impulse Spending Habits?

Seeing the pattern is the first—and most important—step to getting back in the driver's seat. If you’re worried your spending is getting out of hand, there are a few clear red flags to watch for.

Take an honest look at your habits. Do any of these behaviors sound familiar?

- You consistently feel guilty or ashamed after buying something.

- You find yourself hiding purchases or credit card bills from a partner or family.

- Unplanned spending makes it hard to pay your bills or save for important goals.

- You rely on shopping to cope with stress or boost your mood.

- Your closet is full of items with the tags still on that you've never used.

If you're nodding along to a few of these, it’s a strong sign that it’s time to take a closer look at your relationship with shopping.

What Is the 24-Hour Rule for Shopping?

This is one of the simplest and most powerful tricks in the book for shutting down impulse buys, especially online. The idea is dead simple: when you get that sudden, intense urge to buy something you didn't plan for, you stop and force yourself to wait a full 24 hours before clicking "buy."

This mandatory pause is your secret weapon. It acts as a cooling-off period, letting that initial wave of excitement—the dopamine hit—settle down. It gives your rational brain a chance to catch up and ask the important questions.

After a day has passed, you can revisit the item and ask yourself, "Do I really need this? Does it fit my budget?" You'll be amazed how often the answer is a clear "no." The desire has completely faded, saving you from another regretful purchase.

Ready to shop smarter, not harder? At FindTopTrends, we help you discover high-quality, trending products without the guesswork. Use our curated collections, wishlists, and filters to plan your purchases and find exactly what you need, making every buy an intentional one. Explore the latest trends and essentials today at https://findtoptrends.com.