Before you even dream of clicking "add to cart," let's talk about the foundational habits that will become your best defense. Shopping safely online isn't about memorizing a complex rulebook. It's about a few core principles: always confirming a site's security, using payment methods that protect you from fraud, and listening to that little voice in your head when a deal feels too good.

These simple, repeatable checks are your strongest shield against the most common online threats.

Building Your Online Security Instincts

The single most important thing you can do is develop a security-first mindset. This isn't a chore; it's about making safety checks so automatic you don't even have to think about them—much like looking both ways before crossing the street. The goal is to make these habits second nature.

The very first habit? Look up. Before you type a single letter of personal info, glance at your browser's address bar. It absolutely must start with https and show a little padlock icon. That 's' stands for 'secure', and it means the connection between you and the website is encrypted. Think of it as a private, sealed tunnel for your data. If you only see 'http' (no 's'), that's a red flag. Never, ever enter payment details on an insecure site.

Your Payment Choice is Your Safety Net

How you pay can be the difference between a minor hiccup and a full-blown financial nightmare. This is why so many experts recommend using credit cards for online shopping. They come with powerful fraud protection. If a scammer gets your details and makes a bogus charge, you can dispute it with your card issuer and, in most cases, you won't be on the hook for the cost.

Debit cards, on the other hand, are a different story. They pull money directly from your bank account, so when fraud happens, your actual cash is gone instantly. While banks have fraud departments, getting your money back is often a much slower and more stressful ordeal.

For an extra layer of protection, consider using a digital wallet. Services like PayPal or Apple Pay act as a middleman. The merchant gets your payment, but they never see your actual credit or debit card number, significantly reducing the risk of your financial data being compromised in a breach.

A 2023 survey found that 73% of consumers view payment security as their top priority when shopping online. It’s clear that people are worried about fraud and data theft. You can dig deeper into online shopping trends and consumer behavior to see just how common these concerns are.

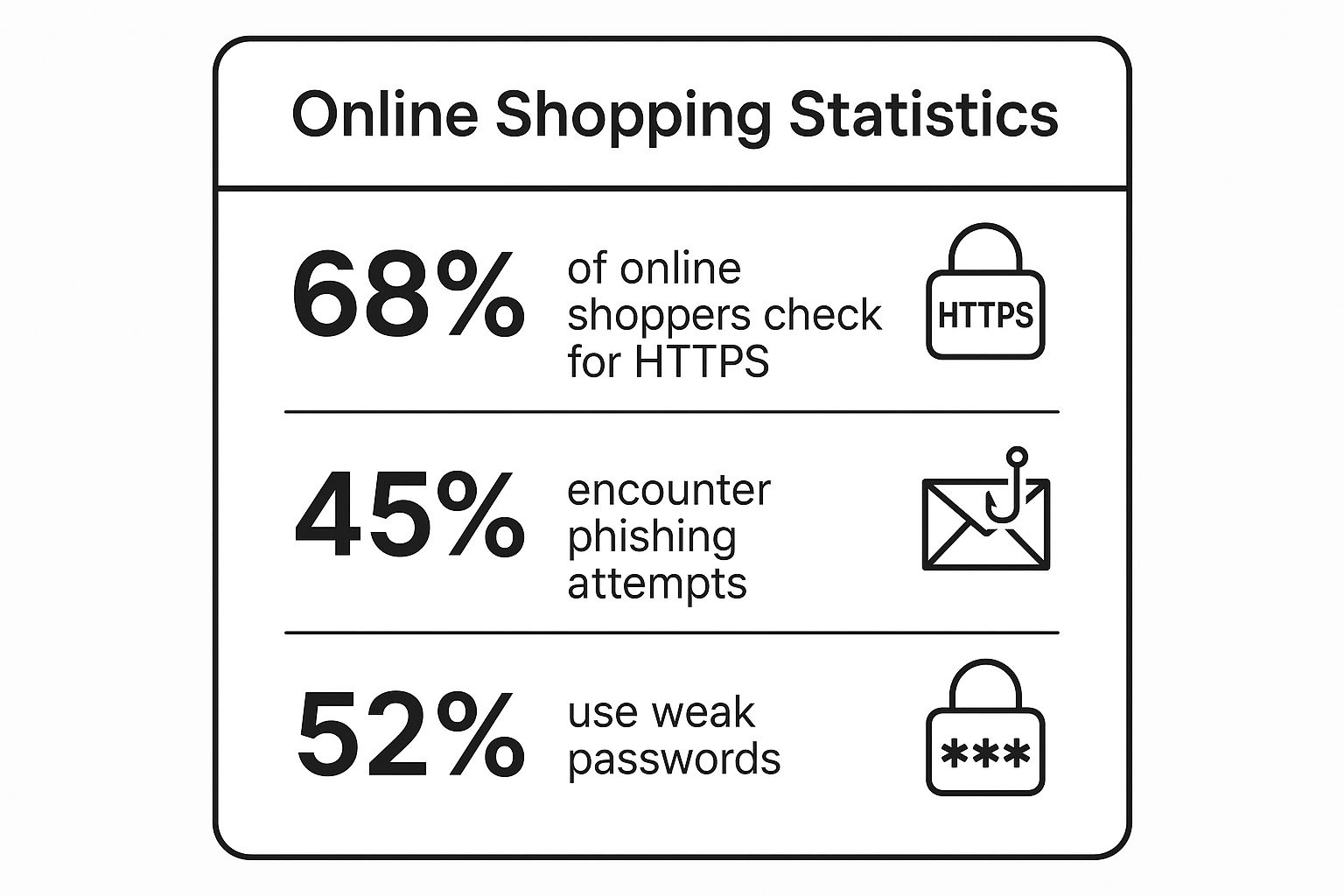

The data below shows just where many shoppers are still dropping the ball.

This highlights a critical gap. While many of us perform the basic security check (68% look for HTTPS), a worrying number are still vulnerable to major risks like sophisticated phishing scams (45% have encountered them) and the fallout from weak password habits (52%).

Your Pre-Purchase Security Checklist

Before you commit to a purchase, it helps to have a quick mental checklist. These are the non-negotiable steps to take every single time you shop on a new or unfamiliar site.

| Security Check | What to Look For | Why It Matters |

|---|---|---|

| Check the URL | The URL must start with https:// and show a padlock icon. |

This confirms your connection to the site is encrypted and private. |

| Review the Website | Look for professional design, clear contact info, and a return policy. | Legitimate businesses invest in their online presence and transparency. |

| Use Secure Payments | Opt for credit cards or digital wallets like PayPal. | These methods offer robust fraud protection if something goes wrong. |

| Trust Your Gut | Be wary of deals that seem unbelievably good or create false urgency. | If it feels like a scam, it probably is. |

Running through these checks takes just a few seconds, but it can save you from days or even weeks of stress and financial trouble. Making this a routine is the smartest way to shop online.

How to Spot a Fake Online Store

The best scams out there are the ones that look almost identical to the real thing. That's why developing a keen eye for the subtle red flags of a fake online store is one of the most important skills you can have as a modern shopper. It's your first line of defense in protecting your financial info.

These fraudulent sites are built to trick you by playing on your trust. You might stumble upon a URL that’s just one letter off from a brand you know, like "Nkie" instead of "Nike." Another classic tell is a deal that seems too good to be true—think a brand-new iPhone for $100. If your gut starts screaming, you should probably listen.

Scrutinize the Website Details

Once you get past the flashy deals, it's the little imperfections that often give scammers away. I've seen countless fake stores with sloppy product descriptions full of typos, a generic "About Us" page that tells you nothing, or a complete lack of contact details beyond a basic web form.

A real business wants you to get in touch. Before you even think about adding an item to your cart, do a quick check for these essentials:

- A physical address: Pop it into Google Maps. Does a real place show up?

- A phone number: Give it a quick call. Do you get a professional voicemail or a real person?

- A clear return policy: If the policy is vague, confusing, or just plain missing, that’s a massive warning sign.

Scammers prey on the excitement of finding a great deal, hoping you’ll overlook the details. Always take a moment to verify a store’s legitimacy before you even consider entering your payment information. This simple pause is your best defense.

Check for Social Proof and Reputation

One of the fastest ways to vet a store is to see what other people are saying about it. A genuine business will almost always have an active social media presence with real comments and engagement. A fake store, on the other hand, might have no social media links at all, or the accounts they link to are brand new with a handful of followers and zero real interaction.

Keep in mind that phishing is a huge problem, with online shopping brands being targeted in 41.65% of financial phishing attempts worldwide. These scams rely on convincing fake sites to steal your data. You can dig deeper into these online shopping threats and statistics to get a full picture of the risks.

Before buying from any new site, I always check platforms like Trustpilot. If a store has no reviews or a sudden flood of terrible ones, I close the tab immediately. It’s just not worth the risk.

Protecting Your Payment and Personal Data

Alright, you've filled your cart and you're at the checkout page. This is the moment of truth, where you hand over what every scammer is after: your financial and personal information. How you handle this final step makes all the difference.

I've learned to think of payment options as having different levels of security. Credit cards are my go-to, and for good reason. They're backed by the Fair Credit Billing Act, which is a huge deal. It gives you the legal power to dispute fraudulent charges—a process called a chargeback—and caps your liability. In most cases, it's $0. So if a thief gets your card details, they can't drain your actual bank account.

Right behind credit cards are digital wallets like PayPal, Apple Pay, or Google Pay. These services act as a middleman, creating a secure buffer between you and the merchant. When you pay, the store never even sees your real credit card number. Instead, they get a unique, encrypted token for that one transaction. It’s a simple way to dramatically cut the risk of your card details getting swiped in a data breach.

Fortify Your Account Access

Your payment info is just one part of the equation. Every online store account you create is another door a criminal might try to open. I see it all the time: people use the same password everywhere. That's like using one key for your house, car, and office—if a thief gets that one key, you've lost everything.

In 2024, the U.S. witnessed the second-highest number of data compromises ever recorded. And guess what? Credit card fraud was a factor in a staggering 43.9% of identity theft cases, with much of it originating from online payment fraud. You can dig into the complete cycrime statistics to see just how prevalent this problem really is.

To lock things down, you need to build two habits into your routine.

- Create Unique, Strong Passwords: I can't stress this enough. Every single shopping site needs its own complex password. A good password manager can generate and save these for you, so you only have to remember one master password. It’s a game-changer.

- Enable Two-Factor Authentication (2FA): Honestly, this should be mandatory everywhere. 2FA adds a second layer of security, usually a code sent to your phone. Even if a scammer manages to steal your password, they can't get into your account without your phone in their hand. Think of it as the deadbolt on your digital front door.

These habits, paired with smart payment choices, create a powerful defense. And while you're focused on being secure, don't forget you also want a great deal. Make sure you also know how to compare prices when shopping online to be a truly savvy shopper.

Staying Secure After You Click “Buy”

Just because you’ve hit the “confirm purchase” button doesn’t mean your job is done. In fact, the moments after a purchase are a prime time for scams. Cybercriminals know you're anticipating emails about your order, and they use this expectation to their advantage with some surprisingly clever phishing attempts.

A classic example is the fake shipping notification. You might get an email that looks like it's from UPS or FedEx, urgently telling you there’s a problem with your delivery. It’ll prompt you to click a link to "verify" your address or payment details to get things moving again. That link, of course, goes to a bogus site designed to snatch your login credentials or drop malware onto your device.

Keeping Your Guard Up After the Purchase

So, how do you stay safe? The best defense is a healthy dose of skepticism. Treat any unexpected email about your order with suspicion, especially if it creates a sense of panic.

Instead of clicking a link in a shipping email, always go directly to the carrier's official website. From there, you can manually type in the tracking number you received in your original order confirmation from the merchant. It’s a small extra step that completely bypasses the risk.

A scam I see all the time is an email claiming your package is "stuck at customs" and you need to pay a small fee to release it. This is almost always a lie designed to get your credit card number. Legitimate couriers have established processes for customs fees, and you should always verify these claims directly with them, not through a random email link.

Beyond your inbox, it's smart to get into the habit of checking your bank and credit card statements regularly. Don't just wait for your monthly statement to arrive. A quick peek online once or twice a week is all it takes to spot a fraudulent charge before it snowballs. Sometimes, a scammer will test a stolen card with a tiny charge—just a dollar or two—to see if it’s active before making a much larger purchase.

If you think you've been scammed, you need to act fast. Here’s what to do:

- Contact Your Bank or Credit Card Company: Call them immediately to report any charges you don’t recognize. They can freeze your card to stop any further fraud and will walk you through the process of disputing the charges.

- Change Your Passwords: If you clicked a bad link or entered your info on a sketchy site, change the password for that account right away. If you’ve reused that password anywhere else (a bad habit, but a common one), change it on those sites, too.

- Report the Scam: Filing a report with the Federal Trade Commission (FTC) helps them track scam trends and build cases against criminals. Your report makes a real difference.

Taking Your Online Shopping Security to the Next Level

If you’re ready to move beyond the basics, there are some powerful ways to lock down your personal and financial information when you shop online. Think of it as upgrading from a standard lock to a full-blown security system. These tactics make you a much harder target for anyone trying to get their hands on your data.

Isolate Your Spending

One of the smartest moves I’ve seen people make is using a dedicated low-limit credit card just for online shopping. This simple step creates a firewall between your everyday spending and your main bank accounts. If that card’s number ever gets stolen in a data breach, the damage is capped at its small limit. Your primary savings and high-limit cards remain untouched.

Another fantastic tool is the virtual credit card number. Many banks and financial tech companies now offer this service. You can generate a temporary, unique card number for a specific website or even a single purchase. Once you're done, you can lock or delete it. For a thief, the stolen number becomes worthless almost immediately.

Fortify Your Digital Environment

The security of your payment method is only half the battle; your device and network connection are the other half. It sounds simple, but keeping your computer, phone, and browser software updated is one of the most effective things you can do. Those updates aren't just for new features—they often contain critical patches that close security holes before criminals can exploit them.

It's a sobering thought, but global eCommerce fraud losses have already hit a staggering $44.3 billion. Even worse, that number is expected to more than double by 2029, thanks to increasingly sophisticated AI-powered scams. You can dig into the details with these emerging eCommerce fraud statistics, which really highlight why taking these extra steps is no longer optional.

Finally, never, ever shop on public Wi-Fi without a VPN (Virtual Private Network). Whether you're at a coffee shop, an airport, or a hotel, a VPN encrypts your entire internet connection. This makes your activity, from browsing to entering your credit card details, completely unreadable to anyone snooping on the network.

When you combine these advanced security habits with savvy buying habits, you're not just protecting your wallet—you're protecting your peace of mind. For more on making great purchasing decisions, be sure to read our guide on how to shop smarter and save money.

Frequently Asked Questions About Online Shopping Safety

Even after you've developed smart shopping habits, specific situations can pop up that leave you feeling uncertain. Let's walk through some of the most common questions and concerns that savvy shoppers run into.

Is It Safe to Save My Card Details on a Website?

This one is all about balancing convenience against risk. I get it—it's tempting to save your card details for a lightning-fast checkout next time. But when you do, you're entrusting your financial data to that merchant's server security. If they ever get hit with a data breach, your card information could be part of the fallout.

My advice? For maximum safety, avoid saving your card information on websites, especially if you're trying out a new or smaller store. A much safer bet is to use a digital wallet like PayPal or a virtual credit card. These services act as a middleman, so the merchant never even sees your real card number.

What Should I Do If My Package Never Arrives?

First off, don't panic. The first step is to grab the tracking number and check it directly on the carrier’s official website—never click the link from a shipping email, just in case it's a phishing attempt. See what the last update says. If it's marked "delivered" but you can't find it, take a good look around your porch, mailbox area, or even ask a neighbor if they saw it.

If the package is truly lost in transit or missing after a supposed delivery, reach out to the seller right away. Any reputable company will want to help you track it down or sort out a replacement. But if the seller is unresponsive or unhelpful, your credit card is your best friend. You can file a chargeback for "goods not received" to get your money back.

You might be surprised by the sheer scale of cybercrime. By 2025, the annual cost of damages is expected to reach a jaw-dropping $10.5 trillion. It's not just a problem for big corporations; over 60% of small businesses that suffer a cyberattack end up closing their doors. You can dive deeper into these figures in this complete cycrime statistics report.

How Do I Know If an Online Deal Is a Scam?

Scammers are masters at exploiting our desire for a great deal. If you see an offer that seems wildly out of sync with every other retailer—think a brand-new iPhone for 80% off—it's almost guaranteed to be a trap. The goal isn't to sell you a product; it's to steal your payment info or personal data.

These "too good to be true" deals are often paired with urgent countdown timers or "only 2 left!" messages to rush you into a bad decision. While snagging a bargain is great, it pays to keep a level head. For more on this, check out our guide on how to avoid impulse buying and make sure your deals are both smart and safe.

At FindTopTrends, we're committed to helping you find incredible products and shop with total peace of mind. Feel free to explore our curated collections of the latest must-haves in tech, fashion, and home goods today.